Long-Term Investors Are Transferring Their Bitcoins From Trading Platforms To Their Own Wallets.

- Posted on April 20, 2024 2:34 AM

- Cryipto News

- 718 Views

When the price of Bitcoin fell below $63,000, the amount of Bitcoin sent to 'accumulation addresses' on April 16th reached a record level of 27,700 Bitcoins.

Long-term Bitcoin holders added a record $1.7 billion worth of BTC to 'accumulation' wallet addresses in a single day, as the price of Bitcoin dropped below $63,000 earlier this week. According to the latest data from CryptoQuant, between April 16-17, over 27,700 BTC (valued at approximately $1.75 billion at current prices) were sent to accumulation addresses in a new daily record for Bitcoin. The previous record was set on March 23, during a period when Bitcoin's price was around $63,500, with 25,500 BTC sent to accumulation addresses in a single day.

These data highlight that when the Bitcoin price was around $63,000, large and determined investors were heavily buying, reflecting their confidence in accumulating Bitcoin for the long term.

An 'accumulation address' is defined as a Bitcoin wallet that has never had any funds withdrawn and holds a balance of 10 BTC or more. These addresses exclude wallets known to be associated with Bitcoin miners and crypto exchanges.

Additionally, such wallets must have been active at some point in the past seven years.

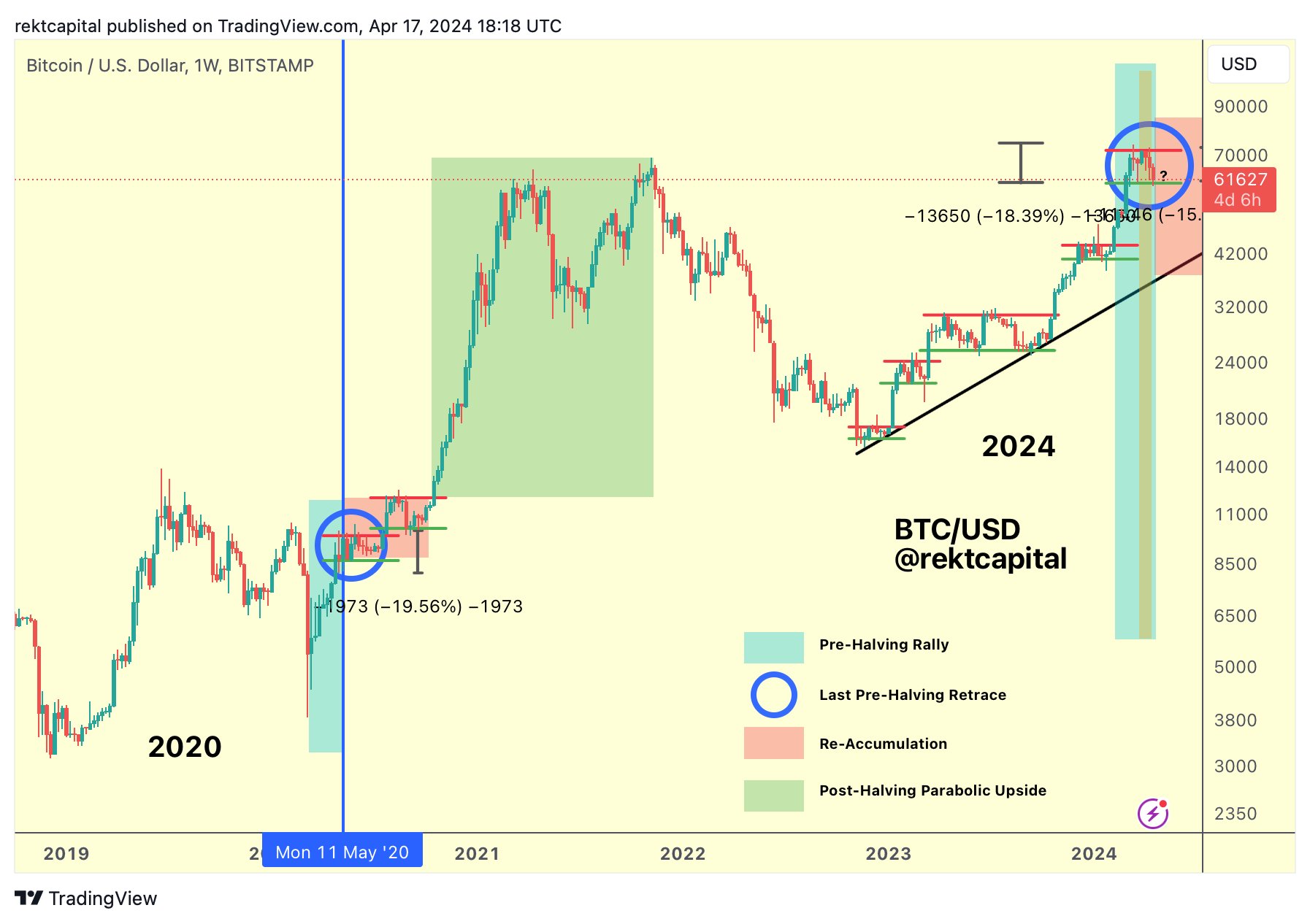

Market analysts, including names like Rekt Capital, emphasize that the early part of this year could be the last period for investors to buy Bitcoin at favorable prices before a significant rally expected after the next halving.

On April 17, Rekt Capital informed his 453,000 followers that the current Bitcoin price movements are following a pattern similar to previous halving cycles. He also mentioned that the recent drop, where Bitcoin lost over 14% from its all-time high of $73,600 on March 13, is part of the "expected pullback before the halving."

It is predicted that after the halving event scheduled for April 20, Bitcoin could enter a "reaccumulation phase."

Rekt stated, "Historically, this phase has lasted about a year (~385 days); however, due to the potential Accelerated Cycle occurring now, this duration could be halved in this market cycle."

Stay updated with the latest developments and news in the cryptocurrency markets by following Kriptospot.com.