Bitcoin Etfs Are Growing Rapidly, Almost Like An Avalanche.

- Posted on February 15, 2024 10:40 PM

- Cryipto News

- 772 Views

Bitcoin ETFs have garnered over $2.2 billion in inflows in the past four days, surpassing the inflows seen in the first four weeks.

Spot Bitcoin exchange-traded funds (ETFs) recorded more net inflows in the past four days than the total inflows in the first four weeks.

According to Apollo's Bitcoin tracking platform, ten spot Bitcoin ETFs recorded 43,300 Bitcoins worth $2.3 billion in the past four days at the current price. It took these funds 20 days to accumulate 42,000 Bitcoins to reach this amount.

We're witnessing total acceleration of #BTC ETF inflows.

— Thomas | heyapollo.com (@thomas_fahrer) February 15, 2024

First 20 days of Trading ~ 42K BTC Inflows

Last 4 Days of trading ~ 43k BTC Inflows 🤯

🚀🚀🚀 pic.twitter.com/IqvX7wI13b

Bitwise's Bitcoin ETF, BITB, became the latest fund to join the "billionaire's club" on February 14th, alongside four other spot Bitcoin ETFs excluding Grayscale.

Today, $BITB crossed $1B in AUM. To our investors: Thank you. We're thrilled for what's ahead.

— Bitwise (@BitwiseInvest) February 14, 2024

- Low-cost 0.20% gross expense ratio

- 10% donation of profits to developers

- 1st U.S. BTC ETF to publish address of holdings

BITB disclosures & prospectus: https://t.co/pAV6kWFfbg pic.twitter.com/HMiv6mzFfn

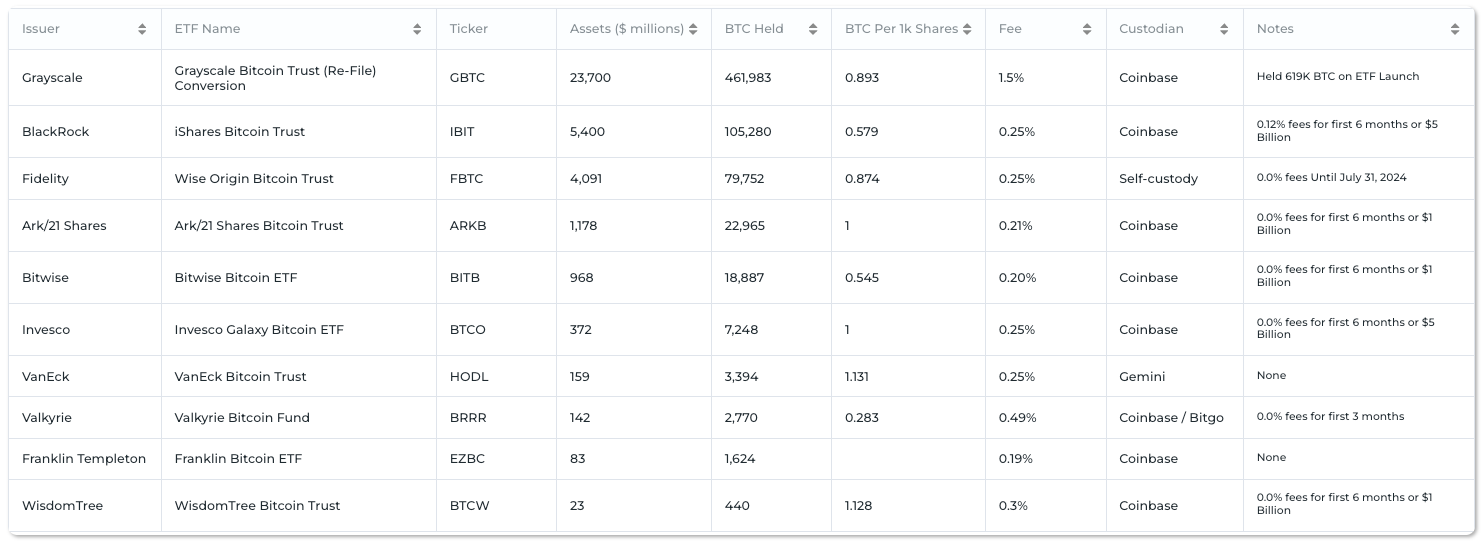

ETF company president Nate Geraci described Bitwise's performance as "impressive," noting that their firm is the only crypto-focused company among the top providers. Despite trailing behind BlackRock iShares, Fidelity Wise Origin, and Ark21 Shares funds, Bitwise is showing a rising performance.

Among other ETFs, Invesco, VanEck, Valkyrie, and Franklin Templeton have yet to surpass the $500 million mark.

WisdomTree's Bitcoin Trust is struggling to gather significant inflows and currently ranks last among Bitcoin ETFs, with assets under management of only $23 million according to Apollo data.

Especially noteworthy is BlackRock's iShares ETF (IBIT) fund, which became the first Bitcoin ETF to surpass $5 billion in assets under management on February 13, increasing its managed assets to 105,280 BTC.

The increasing interest in spot Bitcoin ETFs is considered a significant driving force behind Bitcoin's rally, surpassing $50,000 on February 12.

You can follow the latest developments and news in the cryptocurrency markets in real-time on Kriptospot.com.