Things Seem To Be Going Well For Blackrock's Bitcoin Etf.

- Posted on January 30, 2024 11:43 PM

- Cryipto News

- 762 Views

Bitcoin Enters Interest Rate Decision Week on a Positive Note Amid Increased Interest in ETFs and Price Movement.

Bitcoin managed to hold steady around $42,000 during the opening of Wall Street on January 29th, as GBTC outflows decreased.

It appears that Bitcoin ETFs are beginning to absorb GBTC outflows. According to recent data, the price of Bitcoin continued to retreat from the $42,800 level over the weekend.

The leading cryptocurrency faced previous hurdles after GBTC outflows resumed following a promising weekly close. Currently, the ongoing outflows are hovering around $360 million daily, representing a roughly 50% decrease compared to the previous trading day.

Today's #Bitcoin Sent to out by $GBTC/Grayscale comes out to be ~8.6K $BTC or ~$360M worth.

— Daan Crypto Trades (@DaanCrypto) January 29, 2024

Another decrease from last Friday and about half of what was being sent before.

I think it's safe to assume that flows (on both sides) will slowly cool off from here. https://t.co/wEbbkX6eRU pic.twitter.com/2gtai2dYlK

On the same day, Bloomberg ETF analyst James Seyffart noted that there was a $5 billion outflow following the conversion of GBTC to ETF. On January 26th, despite the negative outlook for GBTC, a total of $759 million inflow was observed into Bitcoin ETFs.

Update for the #Bitcoin ETF Cointucky Derby after Friday (11 days). $5 billion out of $GBTC. Newborn 9 still offsetting those outflows with gross flows of $5.8 billion. Giving us net inflows of $759 million. Volume continued to slow. pic.twitter.com/QTJqqI4aoA

— James Seyffart (@JSeyff) January 29, 2024

According to BlackRock's data, the company's iShares Bitcoin Trust (iBIT) ETF held over 52,000 Bitcoins worth more than $2 billion during the day.

These figures sparked discussions on social media. Investor Rajat Soni measured Bitcoin's daily emission with the current purchase volume. "Currently, only 900 Bitcoins are mined each day. Only BlackRock customers are buying approximately 2-5 times the daily BTC production," he calculated.

FOMC's move is awaited.

While Bitcoin brings an optimistic outlook for investors ahead of an exciting week of macro data releases, the possibility of volatility remains high.

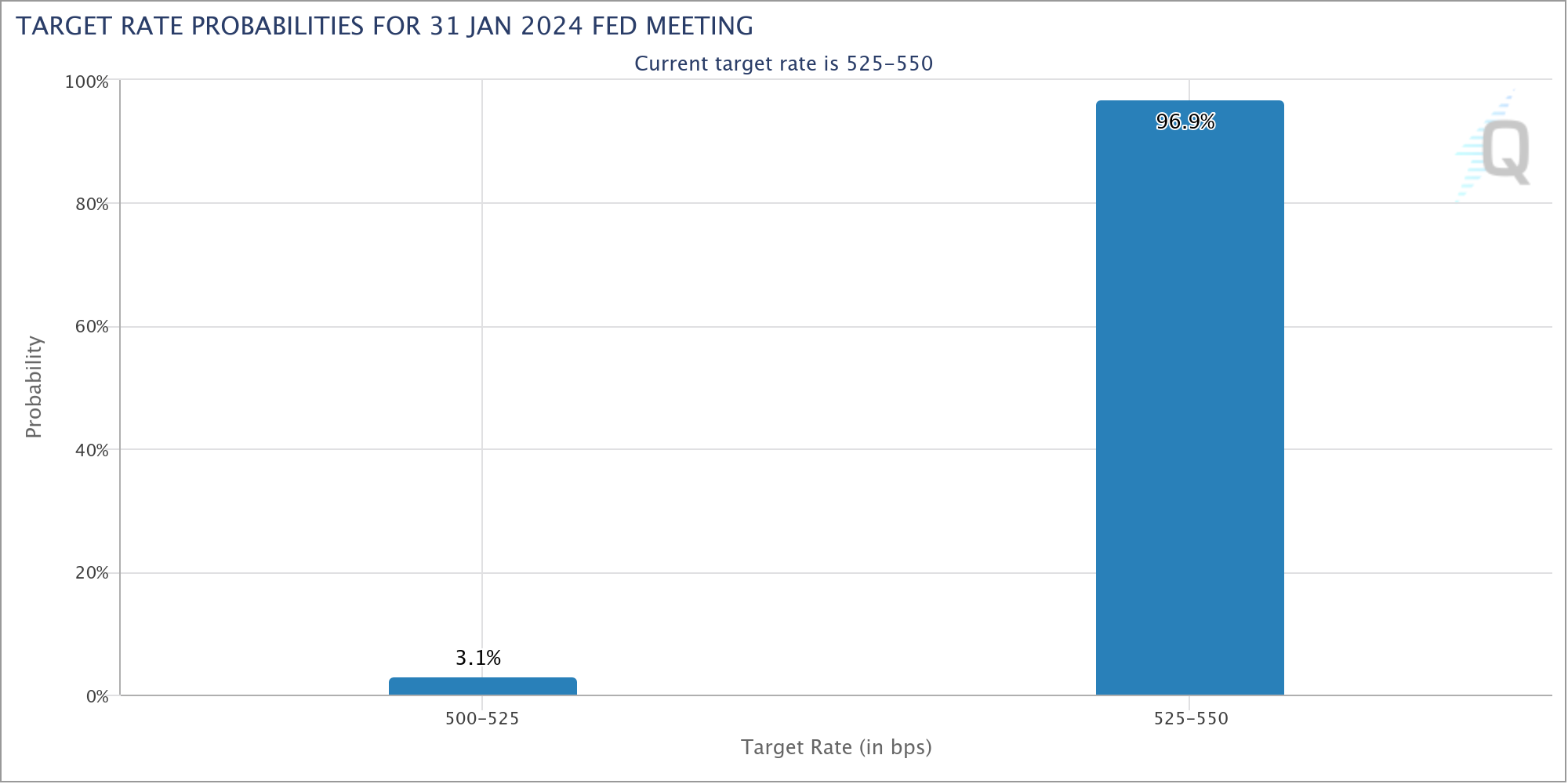

Financial commentator Tedtalksmacro, in a tweet this week, said, "The market currently gives a ~97% chance of the Fed keeping rates steady at this meeting and a 46% chance of a cut in March."

Additionally, it was mentioned that the FOMC's meeting this week is expected to lay the groundwork for an interest rate cut in March.

"In general, I expect this week's meeting to determine the decision to be made in March. This could cause markets to move very quickly depending on Powell's statements," it was said.