What Are The Expectations After The Ethereum Etf Listing

- Posted on July 29, 2024 9:00 AM

- Cryipto News

- 586 Views

Another company predicts that Ether's price will not increase by more than 24% by the end of 2024, assuming there will be low demand for spot ETFs.

The cryptocurrency analysis firm Kaiko indicated that Ether's price could be "sensitive" to spot ETF inflows in the coming days, as investors anticipate a repeat of the low demand seen for futures-based products in late 2023.

Will Cai, Kaiko's head of index, stated in a market report on July 22, "The launch of futures-based ETH ETFs in the US late last year was met with very low demand. All eyes are now on the launch of spot ETFs with high hopes for rapid asset accumulation."

"While a full picture of demand will not emerge for several months, ETH's price may be sensitive to initial inflow numbers," Cai added.

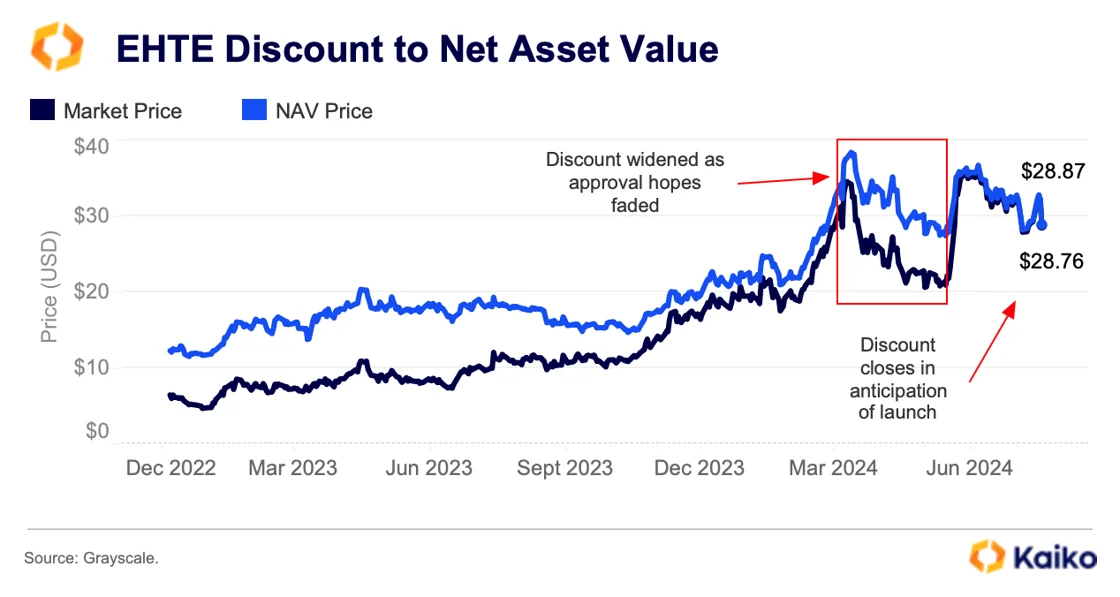

Several spot Ether (ETH) ETFs received final approval on July 22 and will begin trading on July 23. Cai also noted that one of the most significant impacts on the price could be "potential" outflows from the Grayscale Ethereum Trust (ETHE).

The Grayscale Ethereum Trust (ETHE), similar to the Grayscale Bitcoin Trust, is a fund that provides institutional investors with the opportunity to invest in Ethereum (ETH) and includes a six-month lock-up period on shares.

The conversion of ETHE to a spot ETF will facilitate easier trading for investors, meaning that many who hold ETHE shares may wish to liquidate their positions when trading begins on July 23.

Will Cai stated, "The discount to ETHE's net asset value (NAV) grew between February and May as hopes for approval declined but has narrowed in recent weeks." He added, "The narrowing discount indicates that investors bought ETHE below its nominal value and are likely to sell these shares at NAV price during the conversion to profit."

While the launch of ETH ETFs could significantly impact prices, there is less confidence that Ether ETFs will achieve the same level of popularity as spot Bitcoin ETFs.

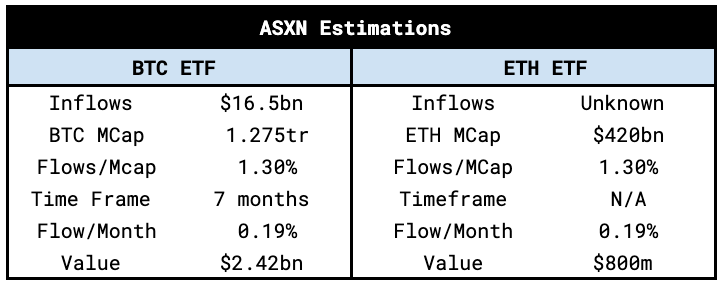

Cryptocurrency market maker Wintermute projected in a July 21 research report that Ethereum ETFs could see inflows ranging from $3.2 billion to $4 billion in their first year. The company anticipates that Bitcoin ETFs will attract approximately $32 billion in assets by the end of 2024, and the total inflows into ETH ETFs in their first year will be about 10-12% of spot Bitcoin ETF flows.

Wintermute does not expect ETH prices to rise by more than 24% by the end of 2024.

On the other hand, ASXN provided a more optimistic forecast in a July 22 X post, predicting average monthly inflows into ETH ETFs of between $800 million and $1.2 billion.

ASXN expects that the impact of any exits from ETHE on the price will be limited due to the lower discount rate.

ASXN stated, "We are open to upward surprises as ETHE has been trading close to the spot price before the listings."

For the latest updates and developments in the cryptocurrency market, you can follow Kriptospot.com.